February 2025

Consumer bifurcation reshaping negotiations between CPG manufacturers and retailers

by Sal Fiordelisi

Back to insights

Back to insights

Discover how the rise of consumer bifurcation is reshaping the CPG industry, with affluent shoppers favoring premium brands and budget-conscious consumers turning to private labels. Learn what manufacturers and retailers must do to adapt, stay competitive, and drive growth in this shifting landscape.

A deep and nuanced understanding of how and why consumers make purchasing decisions is essential for CPG companies and retailers. For consumer businesses this knowledge should be used to inform the development, launch and marketing of their products to ensure they meet their customers’ needs. Retailers must use this information to deliver in-store experiences that do the same.

Consumer bifurcation is an important emerging consumer trend which, if sustained, will have broad implications for branded manufacturers and retailers. It is characterized by affluent consumers continuing to spend, while lower-income consumers make purchasing decision tradeoffs. This trend is going to continue to put increasing pressure on large mainstream and value branded manufacturers to find creative ways to continue to maintain and grow their profitability to remain competitive in this new environment.

The compounding effects of change

The CPG industry has been profoundly reshaped, precipitated by the COVID-19 pandemic as consumers adapted their behavior impacting where they shop, how they shop and what they buy. These changes in consumer behavior were influenced by a number of variables including product availability, changes in household income, savings rate, and personal safety. All the while, both branded manufacturers and retailers were adapting and optimizing their business models to profitably meet these changing consumer behaviors.

Five years later, the CPG industry is now settling into a new normal with a keen eye on future changes in consumer behavior. Consumer bifurcation has manifested itself by creating two very distinct groups that enter retail stores with vastly different mindsets. The more affluent consumers are increasingly purchasing premium brands, while lower income consumers are migrating to the private label. This is,in turn, “squeezing the middle” which is dominated mainstream and value brands typically manufactured by large CPG firms.

This consumer bifurcation trend ,if sustained, could materially impact the composition of the profit pool across several mainstream categories which will undoubtedly reshape the negotiation landscape between large CPG manufacturers and their retail partners requiring a more strategic and collaborative approach to maximize profitability for both parties.

Mainstream category consumer purchasing dynamics

While this may appear to be a new trend, I would argue this has been slowly developing over the last several years commencing with COVID-19 which fundamentally re-shaped where, when, what and how consumers purchase and consume packaged goods. During this period, there were several contributing factors including (1) lack of product supply which lowered the barrier to entry for upstart super premium brands (2) retailer consolidation in the conventional grocery segment due to increased competition by Mass Merchants (Walmart and Target) who grew their low priced and private label assortments and (3) government household fiscal stimulus to temporarily off-set the impact of pandemic.

These factors have contributed to the emergence of a bifurcated consumer landscape with two distinct shopper segments. The first can be characterized as more educated, with higher income, more discerning and less price sensitive. They value brands across a variety of attributes (natural ingredients, fair trade, sourcing, brand story etc.)

In contrast, the second shopper segment is lower income more budget conscious with price being the principal factor in their purchase decision hierarchy.

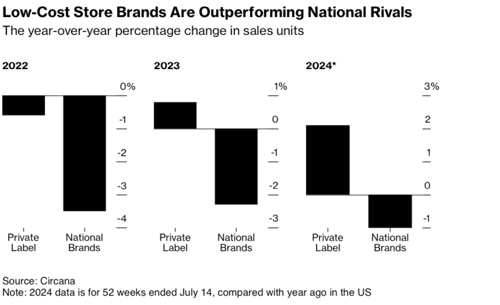

The net impact is that national mainstream and value CPG brands are being squeezed from both top and bottom resulting in volume and share declines. The chart below quantifies the sales unit declines from national brands to private label brands over the last two and a half years. These volume declines will not go unnoticed by CPG branded manufacturers as their profitability is eroding given their large, fixed investments in manufacturing plants.

These same CPG manufactures can no longer ignore the importance of private label in the US where private label brands reached 25.5% of sales last year, which amounted to over $200 billion. Private Label brands are aggressively closing the historic consumer perception gaps of inferior product quality, poor package design, and limited marketing and promotional investment to drive awareness, trial and repeat purchases.

Leading retailers including Walmart, Target and Kroger have invested in developing their private label offerings , acutely aware that consumers have had to endure a significant reduction in purchasing power for everyday essentials. Shoppers' reduction in purchasing power can be traced to the fact that branded manufacturers have grown revenue and profitability by raising prices, shrinking package sizes, reducing promotional support, and optimizing their assortments.

In order to win shopper loyalty, retailers are increasingly focused on tailoring their omni channel strategy to drive profitable growth across both shopper segments. One area of continued emphasis is optimizing category assortments of super premium/premium and private label brand offerings at the expense of mainstream national CPG brands owned by largest food manufacturers (Nestle, Unilever, Kraft/Heinz, and Campbells).

Optimize your negotiation strategy to create strategic value

In this evolving bifurcated consumer landscape, it will be increasingly important for mainstream and value brand CPG manufacturers to do things differently if they are going to continue to maintain and grow market share and category profit dollars.

Planning and understanding points of leverage

It will be imperative that manufacturers invest appropriate resources and time in preparation for their negotiations. As the author Sun Tzu wrote in The Art of War, “Every battle is won before it’s ever fought.” Manufacturers that want to win with these bifurcated consumer groups will need to take the time to strategically plan and prioritize which negotiation trading variables will have the greatest impact on growing category profitability. Understanding their points of leverage and using different trading variables that best showcase their competitive advantage will be paramount.

Collaborate with strategic partners

These CPG manufacturers and retailers will need to collaboratively partner more closely to ensure the optimal assortment balance of mainstream CPG brands private label brands, to meet the maximum number of shopper purchase occasions, to drive category sales growth and profit pool. In some cases, this will require a more collaborative approach since historically manufacturer and retailer incentive structures have not always been aligned causing friction.

Successfully addressing this inherent friction requires a shift in the partnership mindset between manufacturers and retailers, from a competitive orientation of win-lose to a collaborative one of win-win. Creating this shift means investing time in strategically planning for future negotiations to ensure that they are collaborative based on priority negotiation principles such as conditional variable trading in which both parties prioritize variables that are of high value to the other party but at a low cost to themselves.

Make strategic portfolio choices

Change continues to be a constant in the CPG space. Manufacturers that are not able to adapt to this change will lose relevance. It will be critical for mainstream and value manufacturers to have a critical view of their portfolio, re-evaluate the strategic role of private label, assess their brand offerings across premium, mainstream ,and value segments and consider acquisitions to have representation across all consumer segments.

Looking ahead

This consumer bifurcation is going to continue to put increasing pressure on those manufacturers that want to remain profitable and grow in this new normal. Those that are willing to engage with retail partners and consumers in new, creative, and strategic ways will be rewarded, while mainstream and value brand manufacturers that do not adapt will continue to lose market share and consumer loyalty.

This shift in mindset requires a sophisticated understanding and deployment of effective negotiation techniques and the use of advanced negotiation tools. The Gap Partnership’s negotiation consulting, negotiation training and digital solutions are available to those seeking specialist support in these areas. The investment of time and resources in moving to a more strategic and collaborative playing field will pay dividends in the ongoing and evolving consumer landscape.

About the author

Sal Fiordelisi joined The Gap Partnership in 2019 as a Principal. He has a track record of driving profitable growth with high-performing teams across manufacturing and professional services, especially in the consumer packaged goods industry. Sal’s strategic focus includes identifying and quantifying commercial priorities and developing operational plans. He has delivered results for start-ups and Fortune 500 companies.

About The Gap Partnership

The Gap Partnership is a management consultancy specializing in negotiation. We help organizations drive profitability, increase efficiency and reduce cost. Negotiation is an integral part of everything a business does. It exerts a critical influence on the profitability and market value of the organization.

At The Gap Partnership, we provide development programs and negotiation training to our clients. We work with you to understand your challenges and performance needs. Our negotiation consultants come from your industry and will support you with a 'complete' solution that embeds learning, measures capability and delivers sustainable change.

We hold ourselves accountable for your success. 70% of our business comes from clients we have worked with for over five years.

If you require further information on how we can help you and your teams make the most of every negotiation, or simply need to ask us a question - just call, email or complete the form.

Subscribe to our newsletter

We’d love to send you our monthly round up of news, events and products.